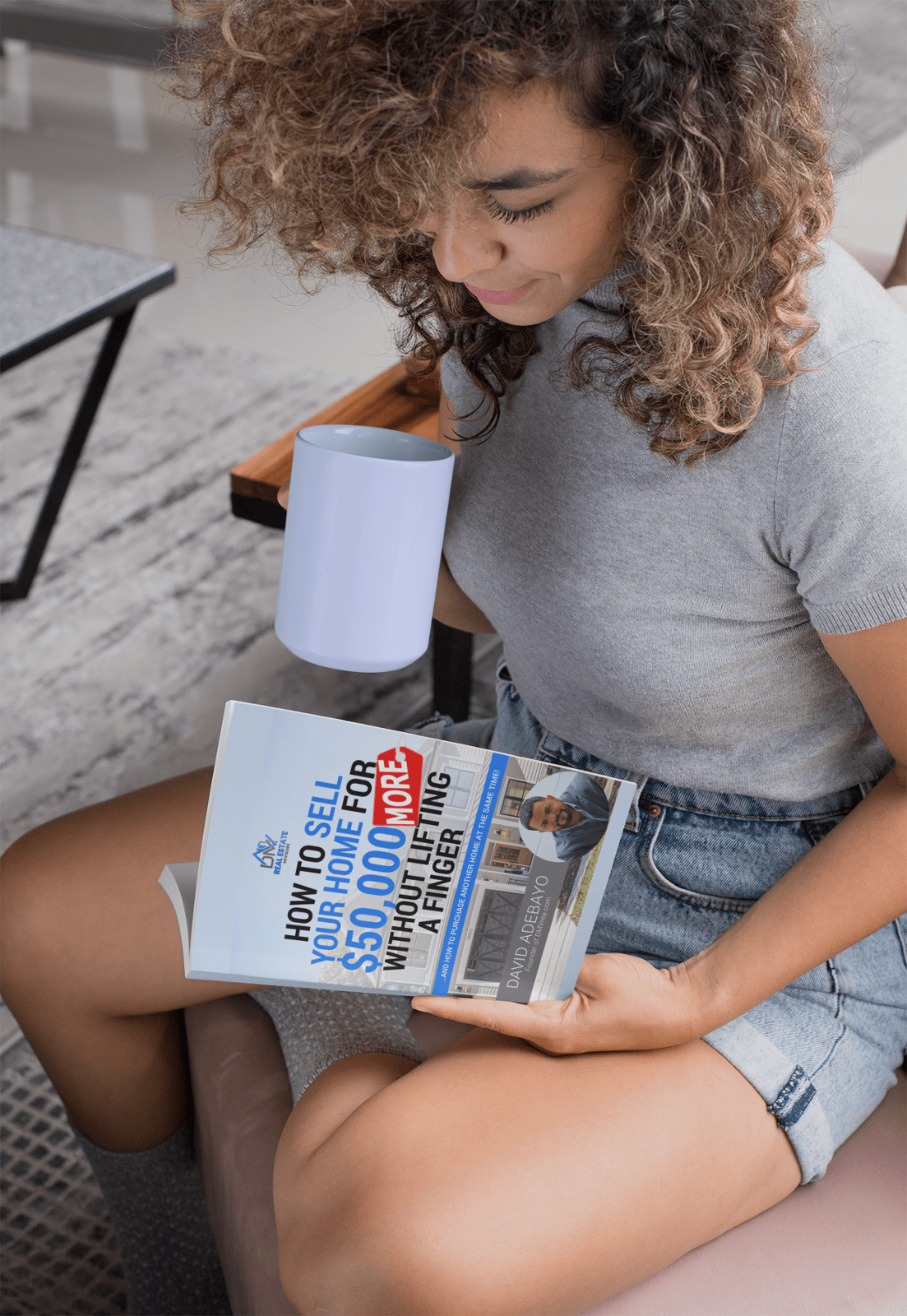

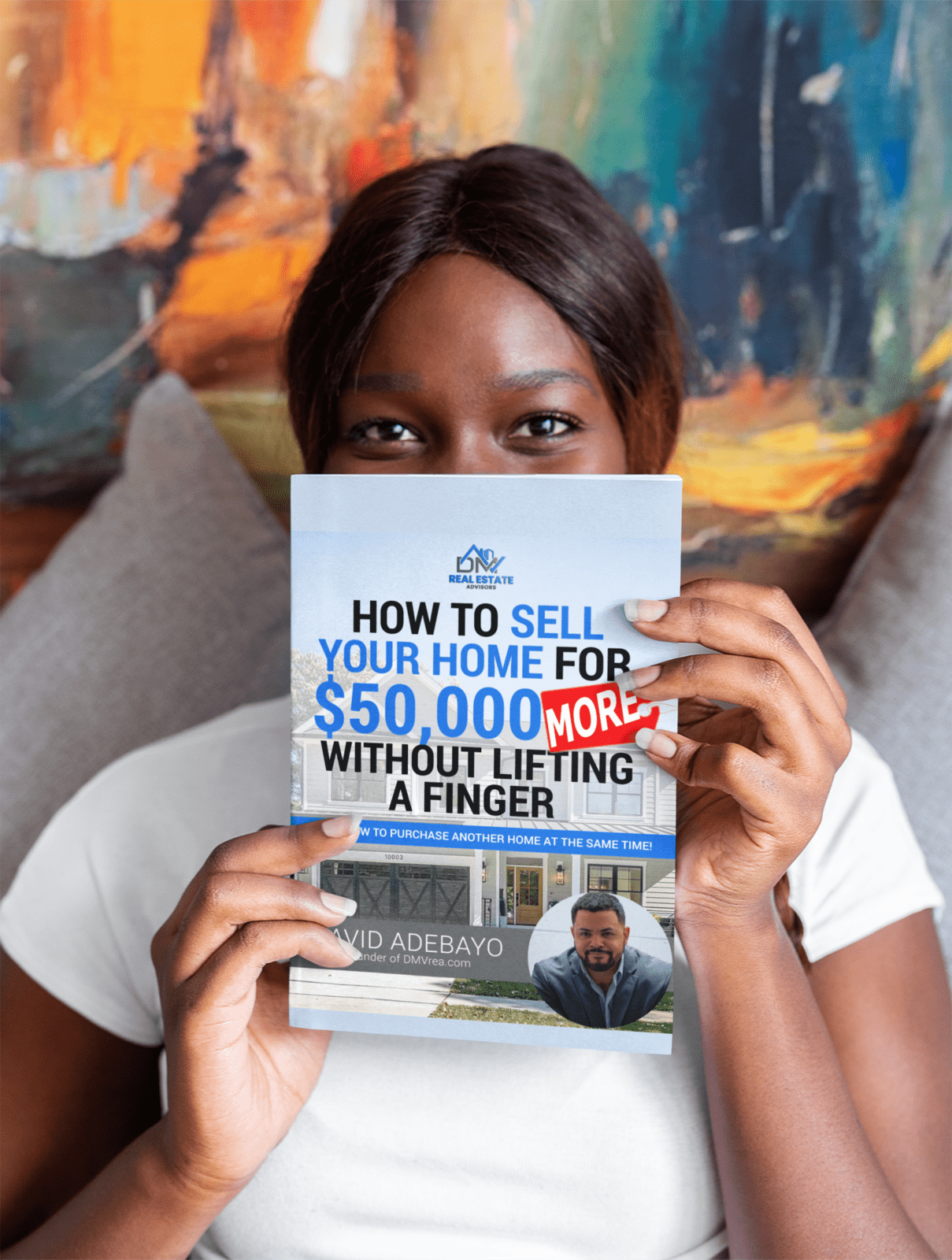

Get your FREE and Accurate Home Valuation

and

Unlock the Secret of your Home's Worth

Learn how to avoid making the same mistakes that

THOUSANDS of other homeowners make EVERY MONTH

when selling their home

100% Free • No Strings attached

• When is the BEST Time to Sell your Property, based on your Goals • Learn How to Create a Strategy • Works on every Property Type and in EVERY Market

100% Free • No Strings attached

Achieving Extraordinary Success

For Extraordinary Individuals

A few clients and friends who have trusted us:

"If You Consistently Surround Yourself With Winners, Winning Would Become The Only Option In Your Endeavors."

Case Study👇

100% Free • No Strings attached

Fail to Plan = Planning to Fail

The plan was simple: Sell Bryan's primary home while the market was hot and then upgrade once the market cooled down. I had helped Bryan purchase his first home in 2017 in Columbia, MD and now in the middle of the pandemic (2021) he wanted to move in with his girlfriend, take advantage of his equity appreciation, and then get back into another home in the same area once the market slows down.

So from beginning to end it went like this:

List home, check

Sell home for $80,000.00 profit, check

Play the waiting game, check

Repurchase property, check... kinda.

See, Bryan is a smart guy, like most of the like minded individuals I work with. He loved Columbia but he was never going to get back into the same kind of property for where he wanted his budget to lie for his long term goals.

Many individuals only think of a mortgage payment in a bubble - as if one does not have any other obligations, dreams, or goals. This in my opinion is WRONG. Life continues outside of your principal mortgage payment.

Bryan expressed to me that he wanted to start investing (an important goal of his) after the next primary purchase. He also said that if he could get into the next property with the least amount of money possible, he would be able to start on the next leg of his goal much sooner as he only has a limited amount of savings. I've known Bryan for a long time and just like me, he likes to think ahead of his current decisions in order to set himself up for the best and expected outcome. As with all of my clients, I like to go over not only what is important to happen in the purchase, but also what the next move looks like, why it looks like that, and where we may find ourselves looking.

I had recently shared with him my Self Preserving Investment Portfolio strategy of growing an investment portfolio (a method that serious investors use to add to their rental portfolio) and he was very interested in beginning to work on that.

If we were to purchase in current conditions, in Columbia, Bryan would end up, at best, breaking even after the sale of his primary. He wanted to look for opportunities that will allow us to accomplish the most. By focusing our search on softer growth markets, we would not only be able to sign and purchase a property with much more favorable terms, but we would also be able to setup this property as an income producing asset that would be able to add to his portfolio down the line without having to spend any additional capital. Theres also a refinancing strategy in this that not everyone knows about- essentially, Bryan would be winning in more than 3 ways by looking at markets 10 min away from his original plan.

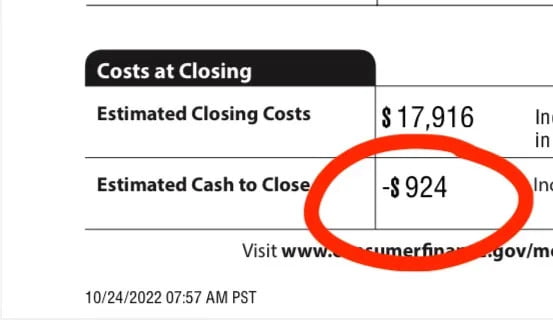

When all was said and done, because we dug deep and PLANNED our timing with the marketBryan was able to purchase a property and

1. Received +$924 back at closing because after seller and program credits, allowing us to get started much sooner on his first investment home

2. He was able to purchase well below market value because of our negotiation strategy, and would be cash flow positive today if he decided to rent out that same home, and

3. Will be able to refinance the property in the coming years (increasing the cash flow and being able to add to his growing portfolio significantly in the future with a refinancing strategy).

Imagine the feeling Bryan had when he received a check instead of handing over a check at closing - all because we took advantage of his situation and spent the time to plan our strategy.